Sky High Projections

Restructuring to manage the winds of change.

The aviation sector is heavily regulated, and any delays in certification by important regulatory agencies such as the European Aviation Safety Agency (EASA) or the Federal Aviation Administration (FAA) in the United States can have serious consequences for companies that operate in this space.

Aircraft certification is a rigorous process that guarantees that aircraft that takes to the skies passes the strictest safety and performance requirements. Fundamentally, the goal of aircraft certification is to reassure stakeholders in the aviation industry and the general flying public that an aircraft is airworthy and capable of carrying people and goods safely. This assurance is attained by a thorough testing protocol that covers rigorous safety tests.

Businesses frequently devote a large amount of resources, for instance, to the development and certification of new aircraft or aviation technologies. Delays in certification can provide a number of difficulties and unknowns for companies operating in the aviation sector, such as manufacturers or operators of aircraft. Delays in certification can lead to higher development expenses and a delay in the production of revenue from operations or sales. This has a knock-on effect on the whole eco-system in the AAM sector, including:

electric charging technology providers,

hydrogen infrastructure players,

low-altitude air traffic management systems,

vertiport developers,

software solutions,

aircraft lessors; and

renewable C&I (commercial and industrial) project developers and solar / wind or other renewable energy producers and related technology.

** Nothing in this newsletter is intended to be or should be construed as being legal or financial advice**

Back to reality

The lack of certainty on the certification timelines has created a challenging investment environment for the AAM sector. Insiders within the AAM sector have long been aware of the large “cash-burn” experienced by many businesses in the sector, and many traditional sources of funding looked less available as the AAM sector moved into the troughs of its “hype-cycle”.

Often times, AAM industry news portals are incentivised to drive up the “hype” more than disseminating sombre news, but the following shows some of the challenges within the industry:

1. Volocopter Exiting Singapore:

In 2019, Volocopter and ITE collaborated to launch the Aerospace Hub at ITE College Central, the first-ever public VoloCity exhibition in Asia. The company then conducted its first crewed public air taxi test flight over Marina Bay in the city centre that same year. It was later declared in 2022 that the company will begin operating air taxi routes in the Marina Bay region in early to mid-2024.

But much to the surprise of the public, the German urban air transportation company announced, in October 2023, that it was leaving Singapore. The company's withdrawal was said to be due to delays in receiving approval from the Civil Aviation Authority of Singapore (CAAS), among other things.

*Note however, more recent news here on Volocopter’s certification approvals in Germany

2. Joby Aviation's Delayed Certification

The FAA's approval of Joby Aviation, an American aerospace startup creating electric vertical takeoff and landing (eVTOL) aircrafts, has been constantly delayed for a while now. The company has been pursuing approval for its ground-breaking eVTOL aircraft, which is intended for urban air mobility.

The US aviation regulator ruled, in May 2022, that eVTOL aircraft will be licenced under Part 21-17B, which calls for special federal rules (SFARs), rather than under the usual standards for small aircrafts. Joby anticipates that the new FAA regulations won't be available until late 2024. The company announced in a shareholder highlights letter in November 2022, that its proposed full certification and start of commercial services in 2024 has been put off by a year, to 2025 because of this delay.

This shows that regulatory obstacles and strict certification standards have made the process take longer than expected and caused delays in Joby Aviation's commercial operations.

*Note Joby’s first delivery for defense applications in September 2023 and analysis signalling a “buy” of JOBY’s stock here after a strong 2023 Q4 earnings report.

3. Lilium

According to some commentators, eVTOL makers like Lilium (leading the pack at 82.7% cash-burn out of total funding raised), appear to be facing increasing challenges despite it being one of the top 10 eVTOL makers leading the charts in terms of orderbooks. By charging ahead with increasing orderbooks, running full scale prototypes and production and forging the path towards certification, there is unfortunately also the draw-back of high cash-burn.

The AAM industry’s reality check in the last 2 quarters brought echoes of a similar time for the commercial aviation industry during the COVID-19 pandemic. When liquidity and financial health is a concern, strategic business owners turn defensive and look towards debt moratorium and insolvency regimes for protection. Here, we set out a summary of the key legal regimes accessed by airlines between 2020-2023.

Restructuring and Debt Moratoriums

** Nothing in this newsletter is intended to be or should be construed as being legal or financial advice**

In the US, Chapter 11 is a provision under the U.S. Bankruptcy Code that allows businesses to reorganize their debts while continuing operations. It provides a legal framework for companies to negotiate with creditors and formulate a plan to repay debts while staying in business. The process involves the appointment of a trustee or debtor in possession who oversees the reorganization process. Creditors also have a say in the restructuring plan, and the court ultimately approves or rejects the proposed plan.

In the UK, a framework for reorganizing financially troubled corporations is provided by Part 26A of the UK Companies Act 2006. Its main objective is to assist financially challenged organizations in addressing their issues by introducing a tool known as a "Restructuring Plan." Companies may, under Part 26A, submit a plan detailing a course of action to members and creditors in order to resolve financial difficulties. Members and creditors must both approve this plan before it may be approved by the court if it is thought to be just and equitable. The restructuring plan becomes legally binding on all creditors and members—even those who initially opposed it—once the court gives its approval. Notably, Part 26A contains clauses that allow for a "cross-class cram-down," which, in certain circumstances, permits the plan to be imposed on shareholders or creditors who are in opposition.

Lastly, the Insolvency, Restructuring, and Dissolution Act (IRDA) in Singapore consolidates various insolvency laws into a single framework. It introduces measures such as debt restructuring, judicial management, and schemes of arrangement to facilitate corporate rescue. The IRDA emphasizes the importance of preserving value and facilitating the rehabilitation of financially distressed companies. It also enhances the regulatory framework for insolvency practitioners and introduces mechanisms for cross-border cooperation.

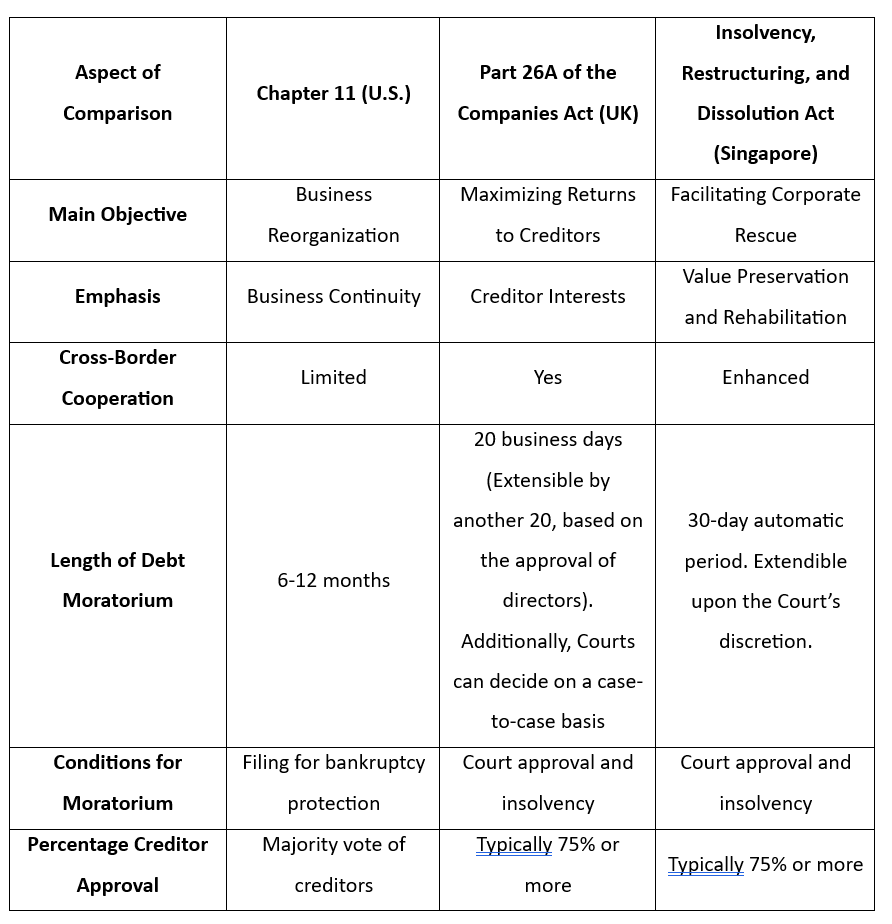

To compare and contrast these legislations, I’ve put together a table that might help provide a very basic overview of various aspects of comparison between the 3 legislations.

It is also pertinent to note that, in the aviation industry, debt restructuring is not uncommon. There are quite a few successful case studies across the US, UK, and Singapore. For instance:

1. Flybe (2020): In order to stay out of bankruptcy, Flybe, a regional airline in the UK, underwent a financial restructuring in the first part of 2020. Renegotiating supplier contracts and obtaining new finance from investors were two aspects of the restructuring. But later that year, the airline finally closed because of the COVID-19 pandemic's effects.

2. American Airlines (2013): As part of its bankruptcy procedures, American Airlines successfully restructured its debt in 2013. The airline obtained fresh funding to sustain its operations and lowered its debt by almost $2 billion. Through this reorganisation, American Airlines was able to come out of bankruptcy stronger and more competitive.

3. Singapore Airlines (2020): In reaction to the terrible impact of COVID-19 on the aviation industry, Singapore Airlines initiated a debt restructuring strategy in 2020. The reorganization comprised obtaining funding from banks and government organizations as well as raising money through a rights issue. In order to lower its financial liabilities, the airline also renegotiated aircraft orders and leases.

4. Garuda (2022): Garuda Indonesia, Indonesia's national airline, was granted Chapter 15 protection by the US bankruptcy courts on October 26, 2022. This protection allows non-US debtors facing litigation claims in the US to restructure and obtain safeguards from creditor actions. Garuda proposed a restructuring plan to its creditors in June 2022, which the Indonesian court approved the same month. Despite appeals from certain aircraft lessors, Garuda filed a Chapter 15 petition with the US court on September 23, 2022, showing its connection to the US through property in New York County and legal representation there.

The US bankruptcy court recognized the Indonesian restructuring plan as the "foreign main proceedings" on October 26, 2022, granting an automatic stay on actions against Garuda and its property in the US. However, exceptions were made for certain aircraft lessors, including Boeing Company and entities of Greylag Goose Leasing, who objected to the petition. The court denied additional relief requested under sections 1507 and 1521(a) of the Bankruptcy Code, citing the need to protect the interests of creditors and the debtor.

While these instances that are a part of the wider aviation industry, and since there are a lot of instances where various players have risen from the proverbial ashes, you can get the sense that there is a certain amount of underlying resilience in this industry. Particularly in the Advanced Air Mobility (AAM) market, with major players such as Boeing, Airbus, Bell Textron, and the likes, while also taking into consideration some of the subjects of this particular article that are rising in prominence such as Joby Aviation and Volocopter, it seems more resilient than ever.

While there might be some softness in the market due to many regulatory and finance issues as detailed above, some statistics suggest that the global AAM Market might rise to almost $68 billion in the coming decade. To give you a idea of the gravity of the forecasted growth, the current market as of 2022 shows a value of $8.2 billion, based on the reports.

I anticipate that defence spending has the potential to significantly boost the AAM industry's innovation and market acceptability, fostering the development of new businesses and facilitating the expansion of urban air mobility as a practical means of transportation. Defence spending can even contribute to the development of comprehensive regulations for urban air mobility operations by supporting research and development efforts in the areas of safety, security, and air traffic management systems. This is because the growing AAM market also places pressure on regulatory bodies like the FAA and EASA to create clear regulations.

AAM technologies, such as eVTOL aircraft and autonomous flight systems, hold promise beyond passenger transport. Industries such as logistics, cargo transportation, medical services, and infrastructure inspection can benefit from the flexibility and efficiency offered by AAM solutions. Through the demonstration of AAM technology's practical utility in industrial applications, companies can expand their revenue streams and access new markets. This diversification beyond the conventional passenger transport markets may stimulate additional funding and innovation in the AAM industry.

It remains an exciting time to be watching the emergence of a new sector as we stand on the cusp of a transformative era where AAM technologies are poised to revolutionize industries and redefine urban environments. Keep checking back as we track the AAM sector's journey and investigate the countless opportunities that lay ahead.

In my earlier newsletter article on autonomous mobility, I discussed the transformative potential of emerging technologies in reshaping transportation systems. I emphasized the crucial role of laws and regulations in facilitating the adoption of these new technologies and creating incentives for their widespread use. To access articles in the archive, do consider subscribing.

** Nothing in this newsletter is intended to be or should be construed as being legal or financial advice**

Participate in this fun poll to unlock the content of this post! Send me a direct message on Substack to see the full post.