Real World Asset Tokenization of Aircraft Assets? Who STO my (aircraft) ABS?

RWA Tokenisation Securitised Token Offerings and decentralised finance solutions to render aircraft ABS (Asset Backed Securitisations) obsolete?

This article is an update of our earlier client-exclusive thought piece titled “Who STO my (aircraft) ABS?” issued in April 2024.

Since then:

the Monetary Authority of Singapore has launched an Industry Collaboration to Scale Asset Tokenisation for Financial Services in June 2024

VMIC, an engine leasing platform in S. Korea has partnered with IX Swap which has been announced to involve the “issuing and distributing RWA tokens backed by aviation assets, including aircraft and aircraft engines, to global investors” in June 2024

Novus Aviation Capital signed an MOU with Mantra to build RWA Layer 1 Blockchain “accelerate the tokenization of assets in the $200 billion aviation financing market” in August 2024

This new updated article summarizes some of the discussions we have had in the transportation market across both the aviation and defi industries, including investors, asset managers and academia.

**Nothing in this article is to be construed as legal or financial advice**

++++++++++++++++++++++++++++++++++++++++

What is Tokensiation and ABS?

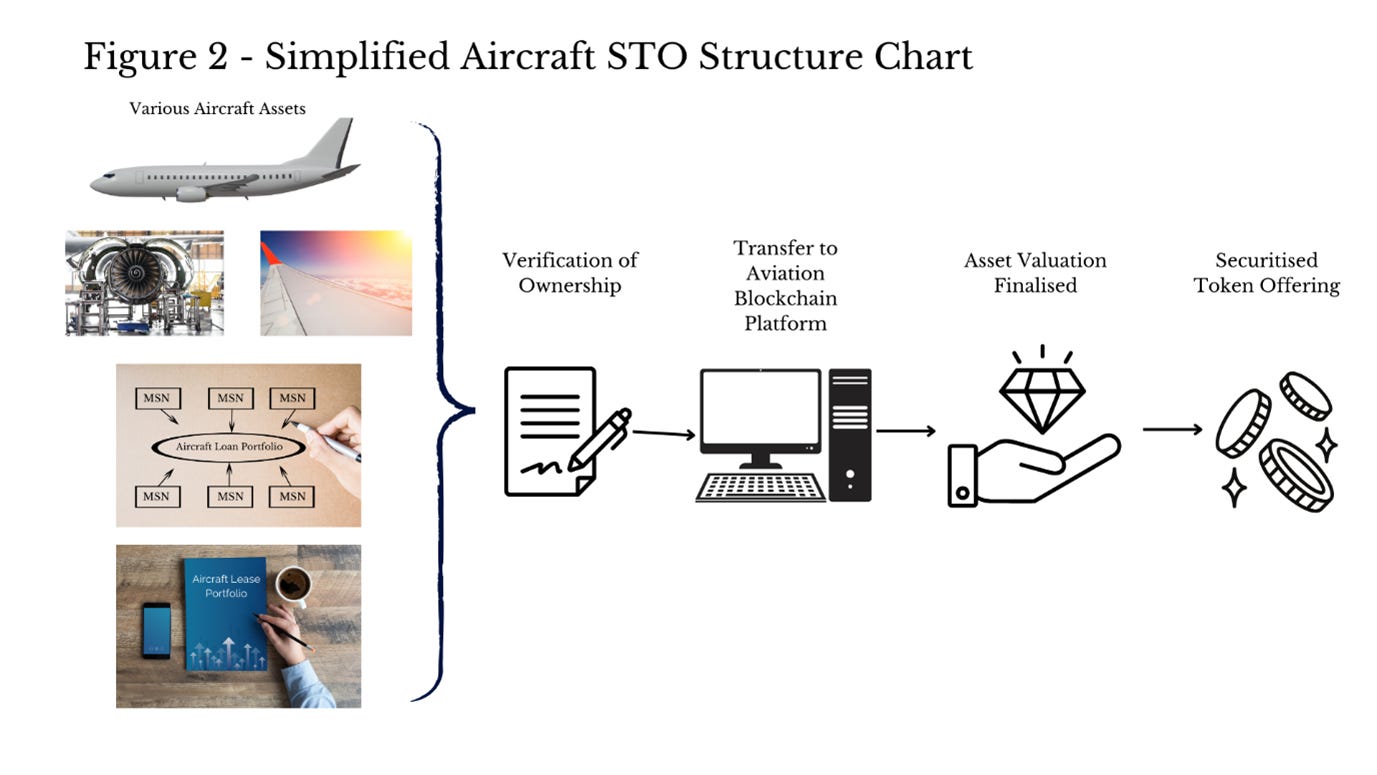

Tokenising assets is the process of issuing a blockchain security token that digitally represents a real, physical tradable asset. Almost any real-world asset can be tokenised such as fine art or intellectual property rights. Tokenisation of aircraft assets likewise allows the ownership of the asset to be split into smaller, liquid parts which can then be easily traded, transferred or exchanged.

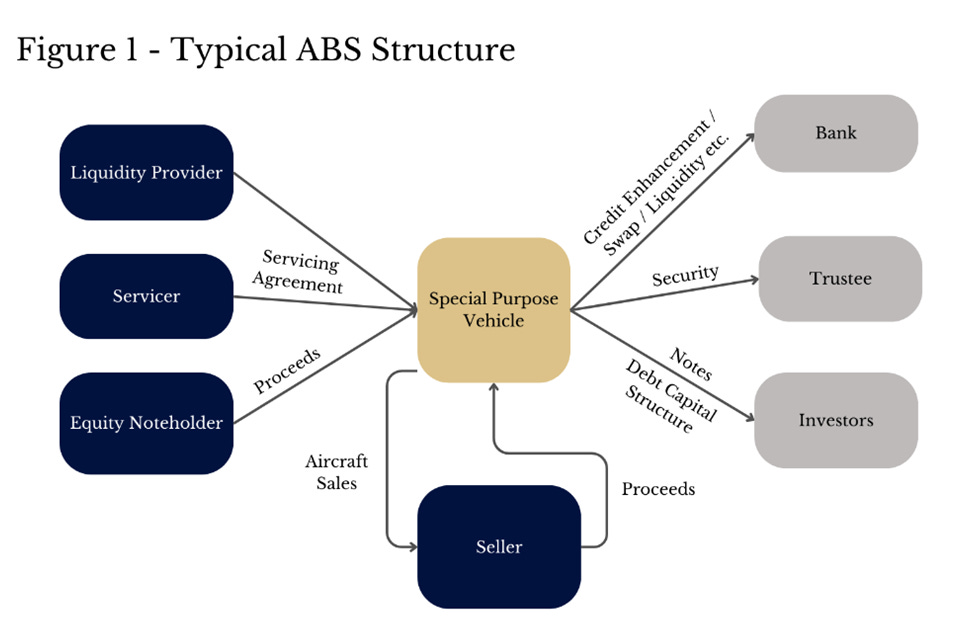

In a similar vein, an Asset Backed Security (“ABS”) is a security that is backed by a pool of assets that generate a cash flow from debt, such as loans, leases, credit card balances, or receivables. A very small number of aircraft ABS entered into in the last two years after the Covid-19 pandemic particularly when compared to the aircraft ABS market size before the pandemic (see article here). Even though ABS documentation is complex and expensive, prior to the pandemic and owing to the growth of decentralised finance, ABS was, in the aviation sector, seen as a more efficient way of accessing new investor pools by converting aircraft leases into tradeable syndicated equity product. Most importantly, ABS structures seemed to be on a growth trajectory.

Practicalities of tokenising assets

The Cape Town convention

It is difficult to discuss tokenising aircraft assets without discussing of the existing system of the Cape Town convention (“CTC”). Prior to the CTC, different legal systems had different approaches to securities, title retention agreements and lease agreements which created uncertainty regarding the efficacy of the rights of stakeholders, particularly lenders. By creating the International Registry of Mobile assets (“IR”), contracting states recognise the international interest created on the IR and as an industry, created predictability and a more straight-forward way of enforcing securities or interests held by stakeholders. In short, the CTC and the International Registry are an important base that underpin all aircraft transactions. Any new system that alters any right or ownership of an aircraft asset, particularly through tokenisation should be capable of “plugging into” the IR system.

Global Aircraft Trading System

The Global Aircraft Trading System (“GATS”) was another key innovation within the aircraft industry. GATS was introduced to facilitate and promote the electronic trading and financing of aircraft equipment in an efficient, secure and predictable manner which, above all, protects the rights of all parties involved including and especially the lessee's rights under the lease. Unfortunately, GATS was poorly adopted partly due to being introduced at the beginning of the pandemic which saw massive restrictions to international air travel. Fewer lease transactions and transfers were seen during the pandemic, and despite keen lessors, airlines seemed hesitant to adapt the GATS system, perhaps due to more pressing grounding concerns. Others speculate that airlines felt they lose negotiation leverage within the GATS process.

Consensys, a private blockchain software technology company, makes a great argument about how blockchain is the “logical next step to be implemented to act as the foundational layer for GATS, upon which other industry products can be built” because GATS standardises documents and transfers them digitally. The question remains – how long can airlines evade the GATS system if tokenisation becomes more prevalent and how can airlines maintain their negotiating power while using GATS when owners or lessors can change relatively easily? How and who do airlines owe obligations to with many fractional owners?

Reality of aircraft tokenisation and ABS

The new wave of tokenisation of real-world assets, particularly within aircraft assets, has already started. Invest Hong Kong announced on 5 February, 2024, that it has assisted a licensed fintech company, EVIDENT Platform Services Limited, to set up its global headquarters in Hong Kong, offering the world's first tokenised private limited partnership fund investing in the aviation sector, in partnership with Anisos Capital Group. Read more about it here.

On 14 August 2024, Novus Aviation Capital has also partnered with Mantra to launch “tokenisation in aircraft financing”, although details of the partnership or structure of the deal. See our news round-up summarizing this deal (and other fascinating updates from the leading edge of transportation & space here)

Taking a step back and peering into the blockchain technology behind the trade, we can see how receptive the manufacturing industry is to blockchain. In 2020, Boeing collaborated with Honeywell’s GoDirect Trade blockchain platform and securely sold $1 billion in Boeing aircraft parts. The idea behind this is that origin of parts can be transparently tracked and demonstrate compliance with safety standards, eliminating the need for physically transferring such documents, amongst many other improvements to the traditional system. However, as an industry, we must question how reactive airlines would be to blockchain and tokenisation given their resistance to GATS.

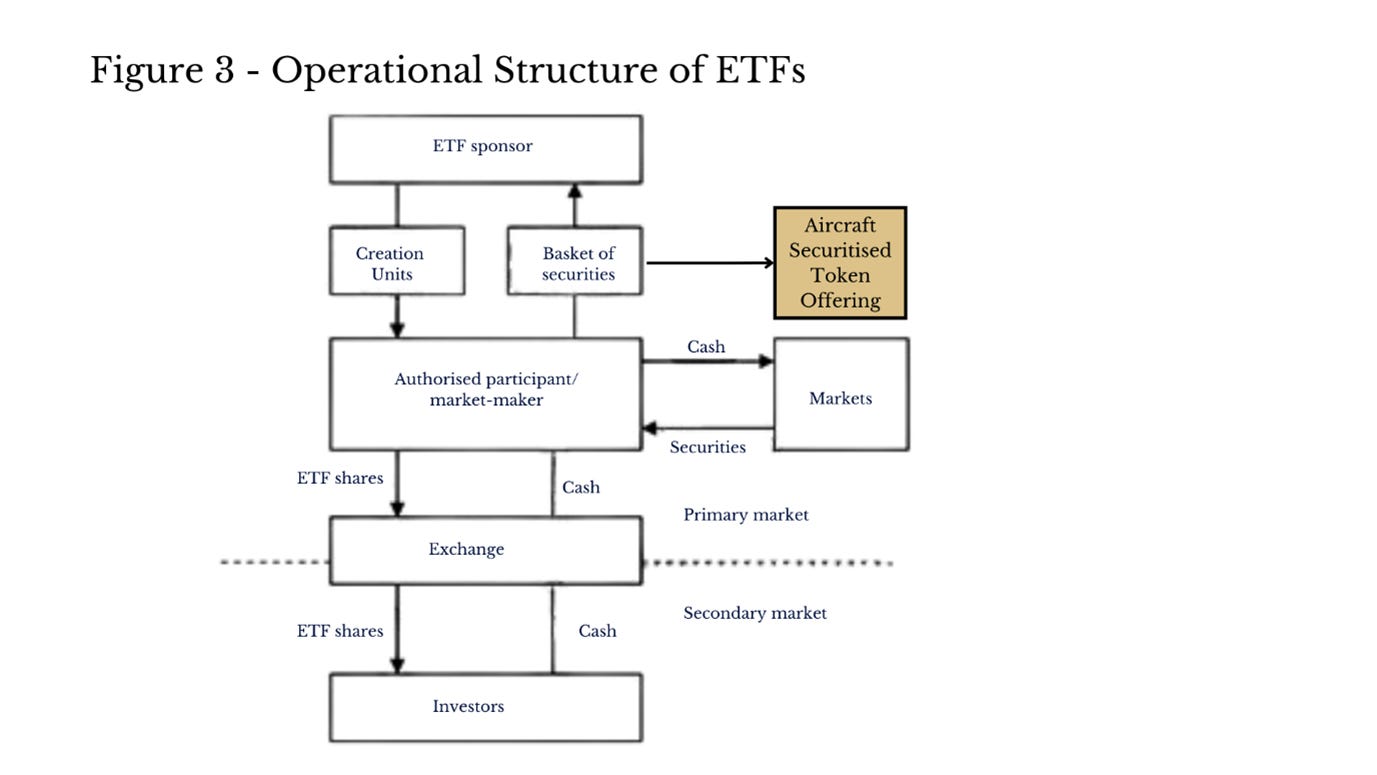

Unlike wine and fine art, aircraft assets are already frequently traded on an international registry, but blockchain allows investors access to more parts of the aircraft – even parts such as Auxiliary Power Units (APU), spare parts and modules which can be very valuable. A Pratt & Whitey APU specific for an Airbus A320neo would cost north of USD 700,000 while a Boeing aileron (one small part of the wings of a plane) costs over USD 1.2 million. In addition to access to these spare parts, investors could now also have the property interest in them tracked just like Honeywell’s system. This is especially important because not only aircraft engines are “pooled” or exchanged between aircraft but these smaller (yet valuable parts) are also often swapped between different airframes. With blockchain at its finest and smart contracts in place, even greater value can be unlocked. Further, with decentralised finance products like cryptocurrency now being made available on Exchange-Traded Funds (“ETF”) (see article here), an aviation assets RWA tokenisation or an aviation equipment leasing or receivables financing Securitised Token Offering (“STO”) can not only reach a different investor base, but parts of an ETF can even be accessed as a similar investor pool to ABS investors, or even investors with a thematic investment play, or with a different risk appetite as part of a diversified equity portfolio.

Challenge

**Nothing in this article is to be construed as legal or financial advice**

The challenge is that real-world asset tokenisation of aviation assets or securitised token offerings of interests in aviation assets are still highly regulated.

STOs are regulated under the same laws as securities offerings which increases cost of compliance and issuance. While RWA tokenisation may not be specifically regulated, it is coming under increasing scrutiny. While some industry commentators are of the view that direct real world asset tokenisation (ie. not tokens representing equity interest in SPVs owning the aircraft assets nor interest in any debt or leasing instrument, but representing an ownership share in the aircraft asset itself) live outside existing regulatory regimes, the reality may not be so clear.

US: Where ownership of aircraft assets is with the expectation of income, it is not inconceivable that investors may be argued to fall within the Howey test in the US which categorizes the token as a security and subject to regulatory oversight which requires registration, exemption or disclosures.

Hong Kong’s Securities and Futures Commission released a tokenisation guidance in November 2023 “Circular on Tokenisation of SFC authorised investment products” which addresses only SFC authorised investment products but makes clear that non-SFC authorised products (which aircraft assets with leases / income streams attached) may fall under would still be classified as complex products for which the general principle of “same activity, same risk, same regulation” would still apply, leaving the issue open.

With the variety of structuring possibilities there are, even the above consideration of SEC / SFC regulations may not be sufficient. Some RWA tokens can look like commodities, banking products or even payment services, each of which tend to trigger different types of regulatory oversight.

In addition to the applicable regulatory regime, issuers and potential investors need also to consider not just the primary issuing jurisdiction, but also the target investor’s residence or deemed applicable jurisdiction given investor protection rules that would generally apply.

Entities wishing to issue tokens may therefore ultimately require one or more licenses to launch and may need to produce an offering document akin to an IPO prospectus.

Providing a more uniquely aviation sector spin to this already complex topic, we want to challenge the industry to think deeper about the characteristics of ownership of aviation assets in the STO or RWA tokenisation of aviation assets.

**Nothing in this article is to be construed as legal or financial advice**

To see more challenging and aviation specific legal issues, please contact us at HL@huilinglawoffice for a deeper discussion.

**Nothing in this article is to be construed as legal or financial advice**

Does one hold shares in an entity holding many aircraft or many single aircraft owning entities; or would an STO be issued per aircraft, and if so, how does this differ from traditional aircraft ownership? Would all these fractional interests i.e. “international interests” capable of being registered on the IR?

Conclusion

In conclusion, there is potential for STO and RWA tokenisations to drive value in the aviation industry and it is even possible that STOs and RWA tokenisations may overtake the asset backed securitisation market for aviation assets (See VMIC and Novus Aviation Capital announcements above). However, in addition to traditional challenges of the blockchain technology and regulatory protection, key specific legal challenges also need to be addressed.

Other initial legal questions also come to mind. Is there a need to get investor consent for waivers of breach in leasing contracts? Would we still rely on recognition of rights agreements or move to a consent based ledger?

Many RWA tokenisation issuances provide for default rules where silence means consent. However, what happens if there is minority shareholder oppression? Would minority shareholder protection legislation apply?

**Nothing in this article is to be construed as legal or financial advice**